How to maximize YO Points in our new Morpho markets

YO is now live on @MorphoLabs, Base’s top lending protocol.

This integration combines YO’s mission to make capital productive with Morpho’s efficient peer-to-peer design for lending and borrowing. The result is deeper liquidity, sharper rates, and a new playground for strategies.

NEW YO MARKETS ARE LIVE!

— YO (@yield) August 22, 2025

Curated by @ClearstarLabs and powered by @MorphoLabs, you can now deposit yoETH and yoUSD on Morpho and borrow WETH or USDC.

Another step towards building the most powerful yield layer onchain. pic.twitter.com/L0pjvno6ye

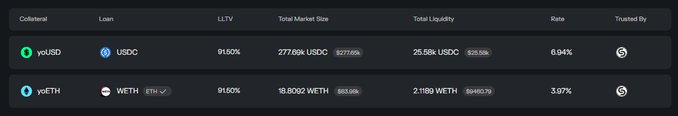

The first markets available are yoUSD/USDC and yoETH/WETH, powered by @ClearstarLabs’ high-yield vaults. Both offer up to 91.5% LTV, which opens the door to higher yield through leverage, with YO Points added as a bonus.

YO markets on Morpho

Farming points via looping

YO Points reward active participation in the YOverse. On Morpho, users can deposit into yoUSD or yoETH markets and stack Points on top of yield. Because these markets support high loan-to-value ratios (up to 91.5%), you can loop your position to increase effective exposure and with it, your Points.

Looping simply means borrowing against your deposit and redepositing the borrowed funds back into the market to increase your position size.

Currently, this is done manually, but it is straightforward.

Here’s how you can scale your position up to ~11x leverage in Morpho’s yoUSD or yoETH markets.

Using yoUSD as an example:

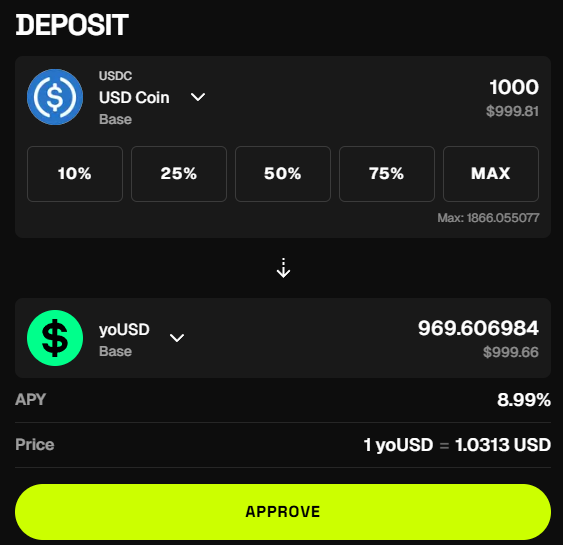

1. Get yoUSD from YO

Go to app.yo.xyz and deposit USDC to mint yoUSD.

2. Deposit yoUSD into Morpho

Head to Morpho, choose the yoUSD market, and deposit your yoUSD.

3. Borrow USDC

Borrow USDC against your yoUSD deposit, up to the safe range under the 91.5% LTV cap.

4. Redeploy the borrowed funds

Take the borrowed USDC and return to app.yo.xyz to mint more yoUSD. Next, deposit this new yoUSD back into Morpho.

5. Repeat the loop

- Borrow USDC again against the redeployed collateral.

- Mint yoUSD, deposit it back into Morpho.

- Each loop increases your exposure to yield and YO Points.

⚠️ Keep in mind this figure represents a theoretical maximum.

Many users may prefer fewer loops to maintain a healthier buffer below the liquidation threshold.

Make sure to keep an eye on your "Health" displayed within the your Morpho Dashboard.

Why leverage matters for YO Points

Each additional loop does not just increase yield exposure, it also multiplies the base used to calculate YO Points.

By compounding deposits through looping, you farm significantly more Points than you would with a single deposit. This is why leverage in Morpho markets can be one of the most powerful ways to climb the YO leaderboard while growing your yield.

But with such amplification comes certain risks.

Risks

- Liquidation risk: Although LTV can reach 91.5%, looping that aggressively leaves less room for volatility. Stopping short of the cap is often wise.

- Borrow costs: Even though yields and Points stack, borrowing always carries a cost. Users should ensure that the additional yield and rewards outweigh the expense of leverage.

- Market conditions: Extreme swings in USDC, WETH, or underlying vault yields can change the dynamics quickly. Regular monitoring is recommended when running high leverage.

- Smart Contract risk: Both Morpho and YO vaults rely on smart contracts. Audits reduce but do not eliminate this risk.

- Gas costs: Multiple manual loops require multiple transactions. For smaller deposits, gas costs can eat into yield.

Encore

For active farmers, these Morpho markets unlock some of the highest yield opportunities available today, with the added bonus of scaling your YO Points. Base APYs become even more rewarding as leverage amplifies returns, and looping allows you to capture a larger share of the yield potential across Base.

The combination of Morpho’s efficiency and YO’s optimization makes these markets a powerful way to grow both yield and rewards.