YO x Euler: One-Click Yield Loops Are Here

⚠️ Risk Disclaimer: This article describes advanced strategies involving leverage, borrowing, and variable interest rates. These carry risks, including liquidation and loss of funds, especially in volatile markets. This content is for informational purposes only. It is not financial advice. Please do your own research.

YO is now live on Euler markets with yoUSD, yoETH and yoBTC, unlocking new ways to amplify your yield. Our integration introduces the following markets:

These markets open up two distinct strategies. You can lend your assets to earn interest and 5x YO Points, or use leverage to loop yoTokens and boost your yield and points.

This guide breaks down how each strategy works and the risks to keep in mind.

For Lenders: Earn yield + 5x points by supplying to Euler markets

If you’re holding idle ETH, cbBTC, or USDC, you can now lend to YO’s Euler markets to earn interest from borrowers looping yoTokens.

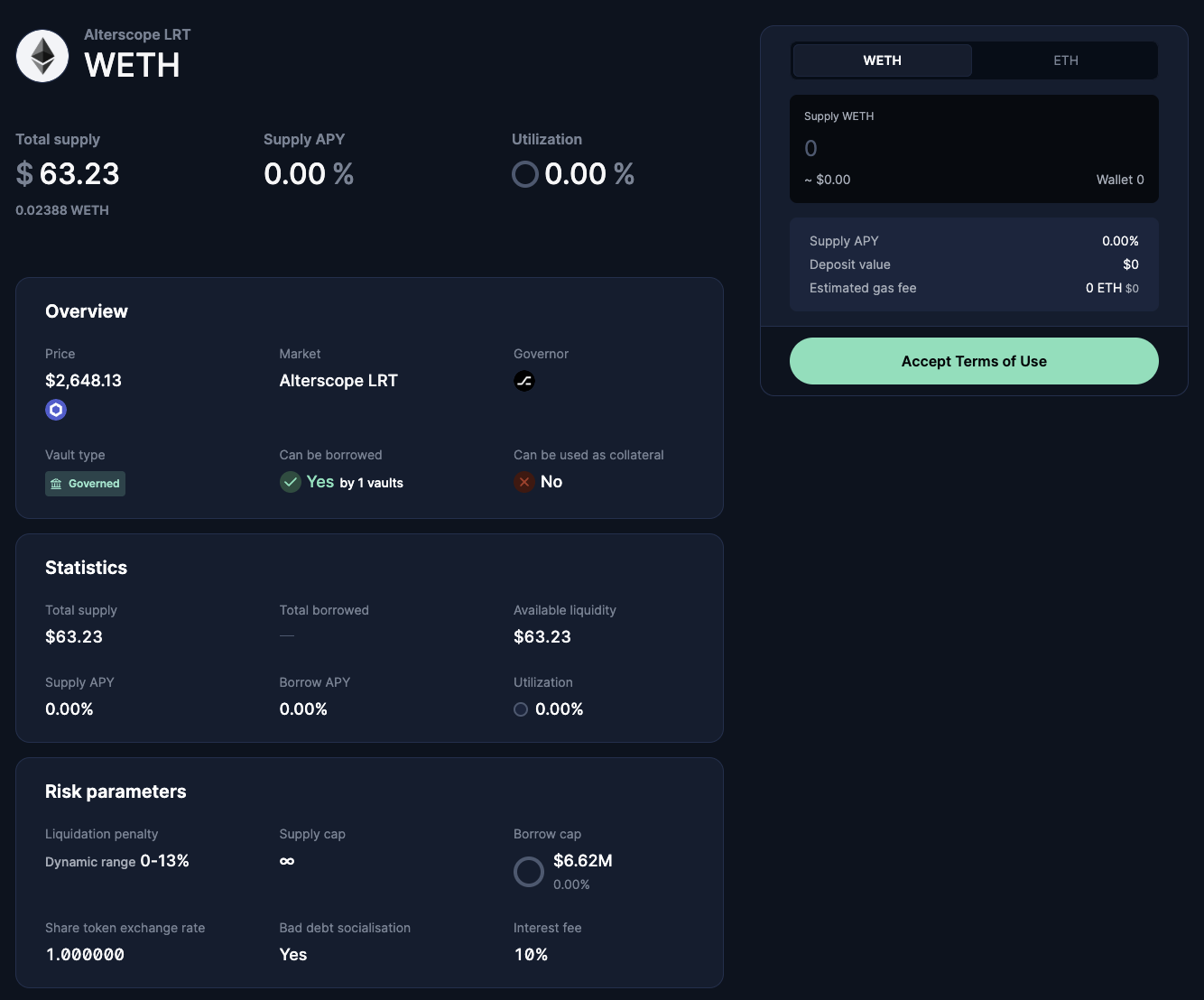

Let’s use the yoETH Market as an example. Once connected to Euler, you can supply WETH and begin earning a variable APY. The rate you earn depends on how much borrowing activity is happening in the market.

Key market parameters:

- Max LTV (Loan-to-Value) 90%: Borrowers can take loans up to 90% of their collateral value.

- LLTV (Liquidation Loan-to-Value) 91%: Loans become eligible for liquidation once they reach 91% of the collateral value.

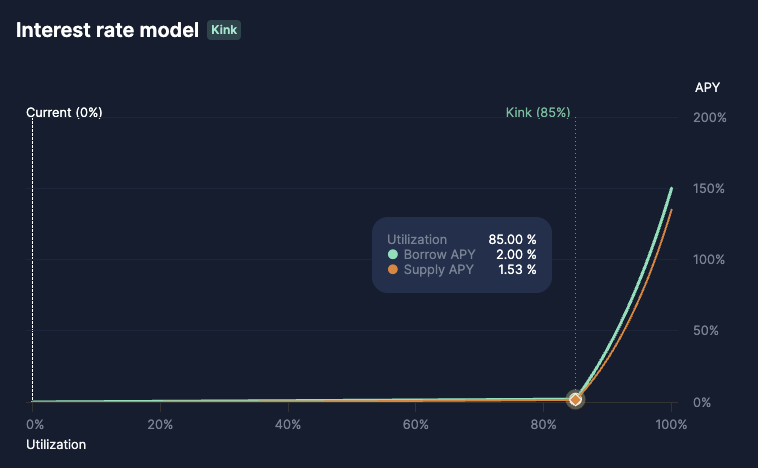

- Interest Rate Model (IRM): Automatically adjusts based on utilization to maintain a target utilization rate of 85%. When utilization is high, borrow rates rise to incentivize more supply. When low, rates fall to encourage borrowing. For example. at 85% utilization, the supply APY is 1.53%.

As more users borrow ETH to loop into yoETH, utilization increases, driving up both the borrow rate and the APY for lenders. This creates a dynamic flywheel where active borrowers fuel passive lender returns.

Lastly, lenders also earn a 5x YO Points multiplier on their deposits, making it one of the most efficient ways to stack points while earning base yield.

For Loopers: Leveraging yoTokens for Higher Yield

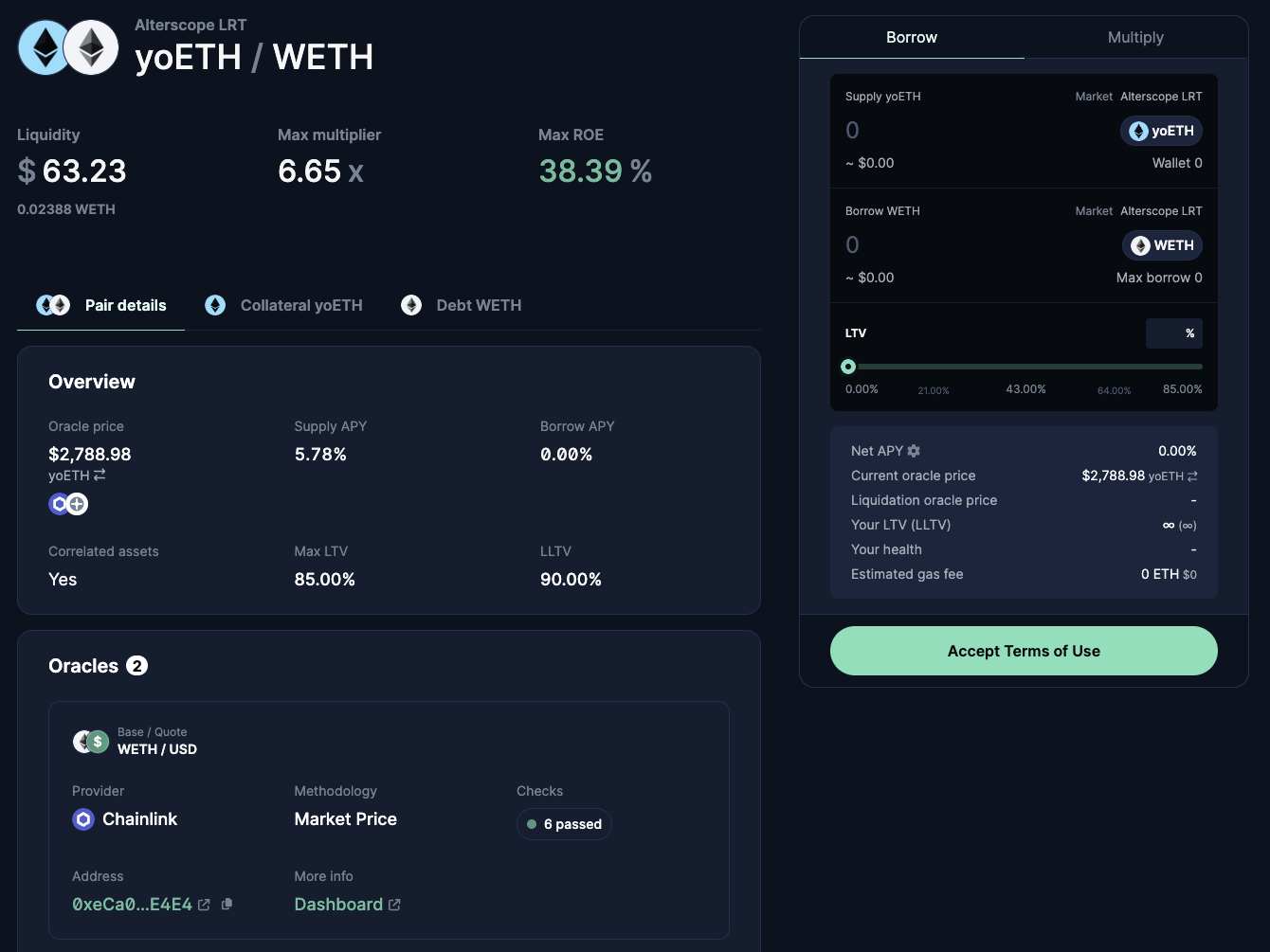

On the flip side, Frontier markets let you use your yoTokens as collateral to borrow the base asset and buy more yoTokens, thus creating leveraged positions that amplified your exposure and yield.

Instead of manually borrowing WETH, swapping it for more yoETH, and repeating the process, you can use Euler’s Multiply feature to simply set your desired leverage multiplier. Euler will automatically handle the looping for you in a single transaction.

Example: Let’s say you want 3x exposure to yoETH

You:

- Navigate to the Multiply tab in the yoETH/WETH Alterscope market

- Specify your desired leverage (e.g. 3x)

- Confirm the transaction

- Start earning 3x the net yield on yoETH (yoETH APY - Borrow APY)

Euler automatically:

- Borrows WETH based on your chosen LTV

- Swaps it for more yoETH

- Supplies the new yoETH as collateral

- Repeats the loop until your target leverage is reached

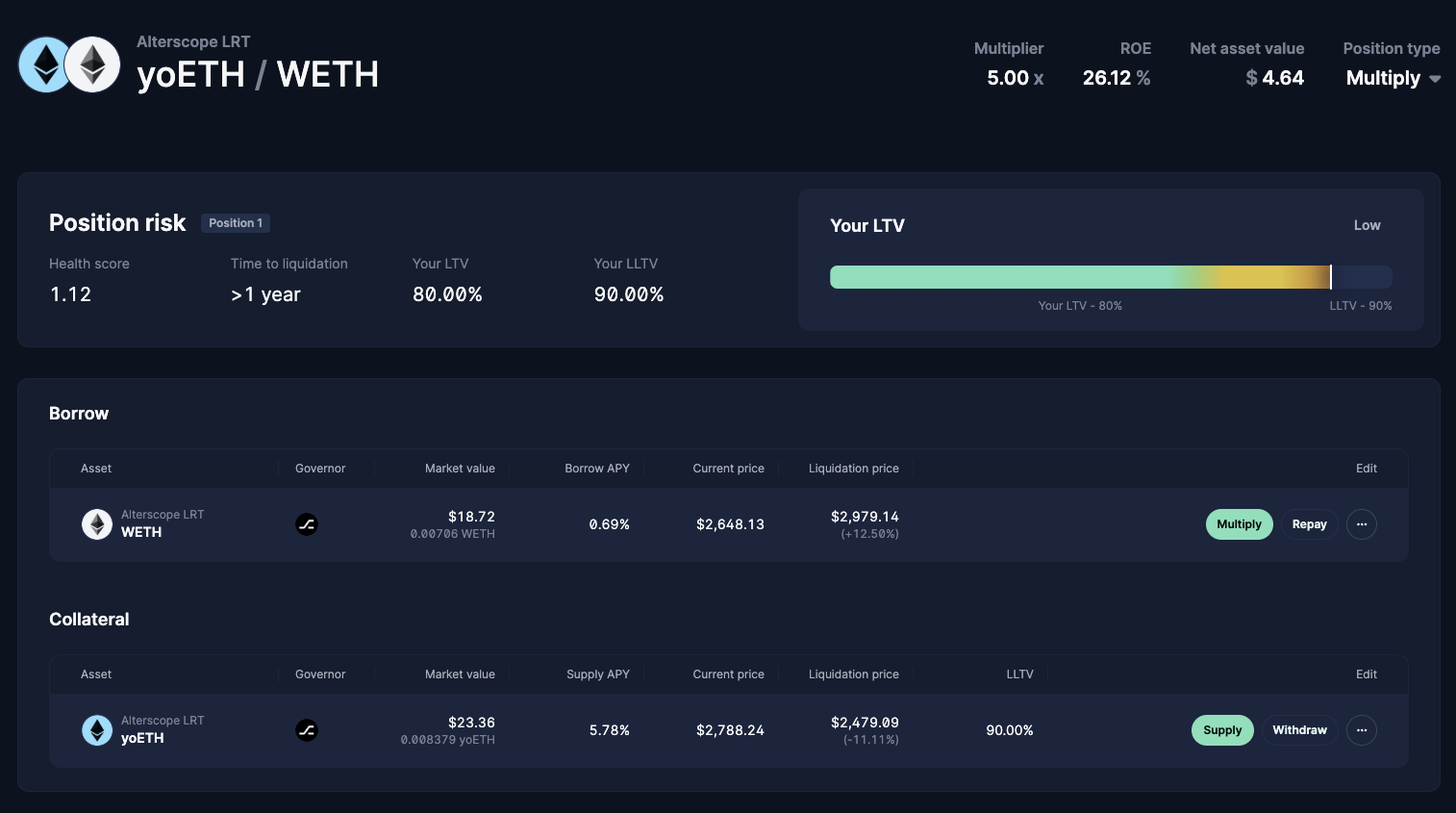

Managing risk when looping

While looping can boost your yield, it also compounds risk. The borrow rate is variable and will change depending on market conditions. Higher utilization leads to higher borrow costs, which can erode your yield or even push your position toward liquidation if unchecked.

Key formula to remember:

Effective Leverage = 1 / (1 - LTV)

At 80% LTV, your exposure is 5x.

Even modest price moves can become amplified at that scale.

As a rule of thumb, most users should leave a healthy buffer to account for fluctuations in borrow rates and liquidity. You can review your position’s health in Euler directly under “Portfolio”.

Conclusion

YO’s integration with Euler Frontier gives users powerful new tools to optimize their DeFi yield strategies. Whether you’re lending for passive income and points or looping into leveraged yoToken positions, these new markets offer flexibility for both passive and advanced DeFi users.

Just remember: with great power, comes great responsibility. Stay sharp, monitor your borrow rates, and manage your position proactively.

May the Yield be with you.