Understanding Risk-Adjusted Yield

Yield is the vital force behind everything we do at YO. More than just numbers on a dashboard, yield represents the health and performance of our vaults.

However, not all yield is created equal, and at YO, our focus is risk-adjusted yield. That means every decision made by the protocol aims to maximize yield for a given level of risk, dynamically allocating deposits to the most attractive opportunities and withdrawing from those that are less efficient.

Let’s break down where YO’s yield comes from, how it’s distributed, and how our risk-adjusted framework ensures every vault grows safely and sustainably.

Where does the yield come from?

First, it’s important to know that vault allocation consists of two key components:

- Underlying pools

- Yield optimization algorithm

Yield accrues through the various underlying pools and strategies that each vault invests in. These can include lending markets, liquidity pools, or other DeFi strategies that produce real onchain returns.

The vault’s total yield is calculated as the weighted average of all yields across its underlying pools, factoring in both active investments and any idle assets. As yield accrues, it’s distributed proportionally to all vault participants, reflected through their holdings of yoTokens.

YO uses a yield optimization algorithm to dynamically allocate capital across the underlying pools. The algorithm continuously evaluates all whitelisted opportunities, taking into account both yield and risk, and determines where each new deposit should go to maximize risk-adjusted return.

When users deposit, funds are directed into pools offering the most attractive yields per unit of risk. When users withdraw, redemptions are sourced from the least attractive pools. This mechanism ensures that capital is always deployed efficiently, maintaining diversification while optimizing safety and performance in real time.

What is risk-adjusted yield?

Traditional yield metrics focus purely on return. But in DeFi, a high yield can sometimes signal higher risk, whether from smart contract vulnerabilities, liquidity depth, or counterparty exposure. Risk-adjusted yield goes a step further by evaluating how much yield you earn per unit of risk.

YO integrates Exponential’s risk scoring system to quantify the relative safety of each pool. Each pool receives a quantitative score that represents its estimated probability of total loss, or the likelihood of a “wipeout” event where all capital could be lost.

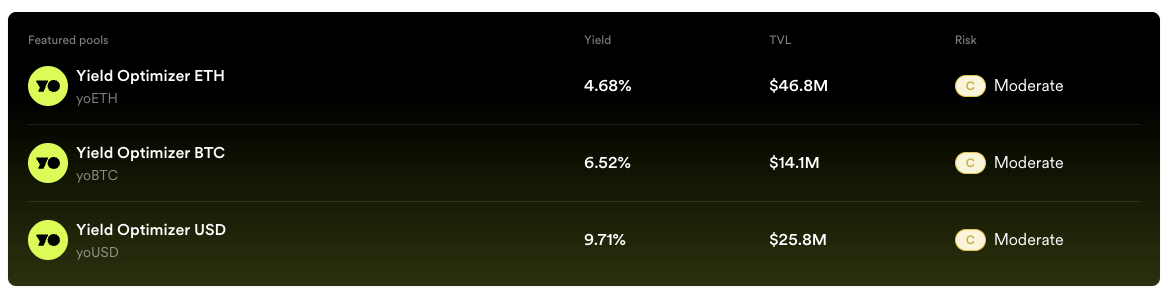

For example, we can see here that yoETH, yoBTC, and yoUSD have a Moderate (C) risk rating. This means that there is a moderate risk of losing your investment due to potential security and risk management issues. The final rating is a result of the compounding of risks at the chain level (Base), protocol level (YO), and the underlying yield strategies for each vault.

By combining each pool’s APY with its associated risk score, YO can calculate a risk-adjusted yield that reflects both returns and safety. The protocol’s algorithm then determines the optimal allocation, the mix of pools that maximizes the vault’s overall return while minimizing risk.

In other words, YO continuously answers this question:

Given today’s opportunities, where should every dollar in this vault go to earn the best possible yield for the least amount of risk?

Sustainable yield, optimized for safety

By combining algorithmic allocation with quantitative risk assessment, YO delivers yield that is both sustainable and defensible. Every vault evolves in real time, adjusting its exposure as risk profiles and yields shift across DeFi. Depositors no longer have to chase yield or manage risk themselves. The result is steady, organic yield that reflects real onchain activity rather than speculation.