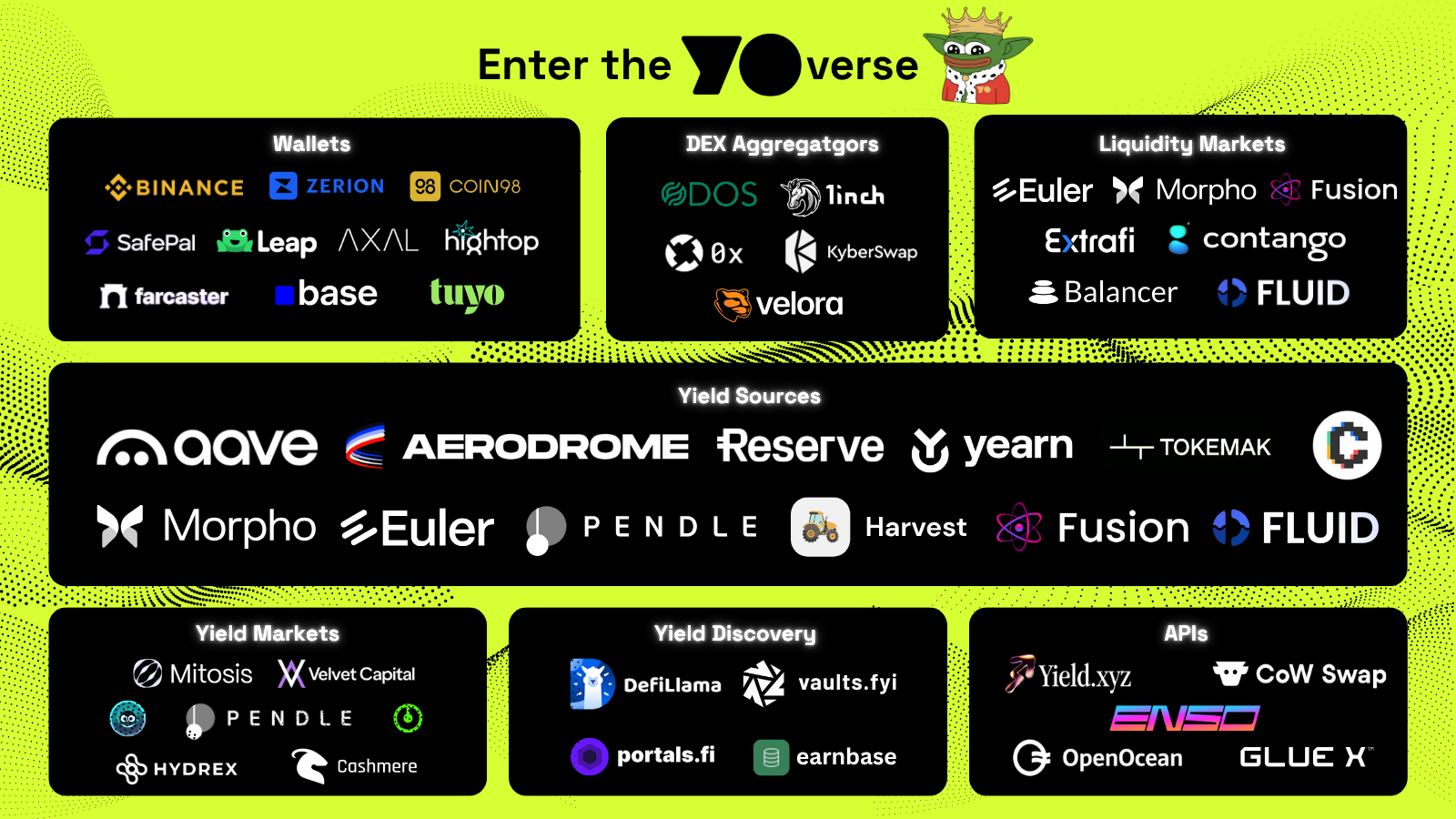

Enter the YOverse: Mapping YO’s Expanding Integrations

At YO, growth isn’t just about vault performance. It’s about how yoTokens are spreading across DeFi to become true building blocks of the onchain economy. The YOverse captures this expansion, a map of all the places where yoETH, yoUSD, and yoBTC are already plugged in and powering new use cases.

Three Layers of Integration

YO’s integrations span across three layers of DeFi:

- DeFi protocols: where yoTokens are used directly in lending, liquidity, and yield trading.

- Backend routing: where YO connects to execution infrastructure to keep vault operations smooth and efficient.

- Wallets, APIs, and dashboards: where users can access YO seamlessly through the tools they already use.

Together, these layers show how YO is evolving from a single app into a composable financial primitive woven throughout DeFi.

DeFi Protocol Integrations: Making yoTokens Work for You

ERC-4626, the tokenised vault standard, unlocked the true scaling moment for vaults. Because yoTokens are ERC-4626 compliant, they integrate anywhere in DeFi just like an ERC-20, meaning your yield doesn’t stop at the YO app.

Here’s where yoTokens are already live today:

- Lending & Borrowing: Supply yoETH, yoUSD, or yoBTC as collateral on Morpho or Euler to loop, borrow, or manage leverage.

- Liquidity Provision: Provide liquidity on Balancer with pairs like yoUSD–USDC or yoETH–WETH to stack trading fees on top of vault yield.

- Yield Trading: Split yoTokens on Pendle into principal and yield components, letting you lock in fixed returns or speculate on future yields.

- Smart Lending Platforms: Use yoTokens as collateral on Euler and Morpho for leveraged strategies and active debt management.

📊 Adoption snapshot:

- 44% of yoETH supply is already deployed across Pendle, Euler, and Morpho.

- 26% of yoUSD supply is circulating in lending markets and LP pools.

- 11% of yoBTC supply is integrated across DeFi, setting the stage for more growth.

Backend Routing: Efficiency Under the Hood

Running dynamic strategies across chains requires constant rebalancing. Without good routing, slippage and thin liquidity eat into returns. YO solves this by plugging into leading aggregation infrastructure like Enso, 1inch, Odos, and Cow Swap.

These platforms source liquidity from across DeFi, ensuring vault transactions are executed at the best possible path and price. The result:

- Users capture the full yield of strategies.

- YO scales across multiple chains without building its own execution layer.

- Everything remains transparent and verifiable onchain.

Wallets, APIs, and Dashboards: Bringing YO to More Users

For adoption, access is everything. That’s why YO is integrated directly into wallets and dashboards where users already manage their assets:

- Wallets: Base, Farcaster, Tuyo, Coin98, SafePal, Leap, Binance Web3 Wallet, Axal, HighTop.

- Dashboards & APIs: Zerion (in-app deposits), Yield.xyz (vault data), Axal (yoUSD product suite).

These integrations remove friction. Users can deposit into vaults, track performance, or deploy yoTokens without leaving the tools they already trust.

Tuyo is the first wallet with native YO integration, offering one-click access to DeFi yield. Instead of hopping between dApps and protocols, users can allocate to yoVaults directly from their wallet interface. This kind of embedded UX marks an important step for mass adoption, bringing yield out of niche dashboards and into the everyday wallets people already use.

The YOverse in Motion

YO is not just another vault platform. By depositing into YO, you’re tapping into an expanding network of integrations that makes yield accessible everywhere in DeFi. From lending markets to wallets, yoTokens are becoming native money legos that plug seamlessly into the broader ecosystem.

As the YOverse grows, so do the opportunities for users. Whether you’re an individual chasing steady returns or an institution building structured products, yoTokens are designed to move with you, across chains, protocols, and platforms.

The YOverse isn’t a roadmap. It’s already here.